This article will try to explain the economic model design of the Spyder Protocol, mainly involving token distribution, mining rules and incentives, deflation mechanism, and analyze its application prospects and the flow of tokens in detail. This article is more than ten thousand words, the reading time is 15 minutes, because involves the specialized domain knowledge, the reading may be difficult, please understand

◇Preface:

Spyder Protocol is what?

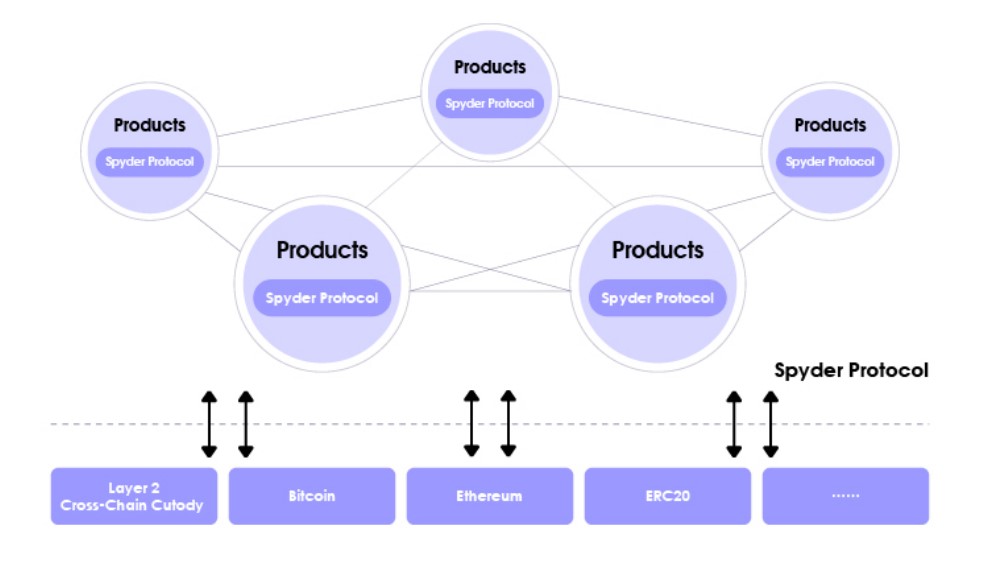

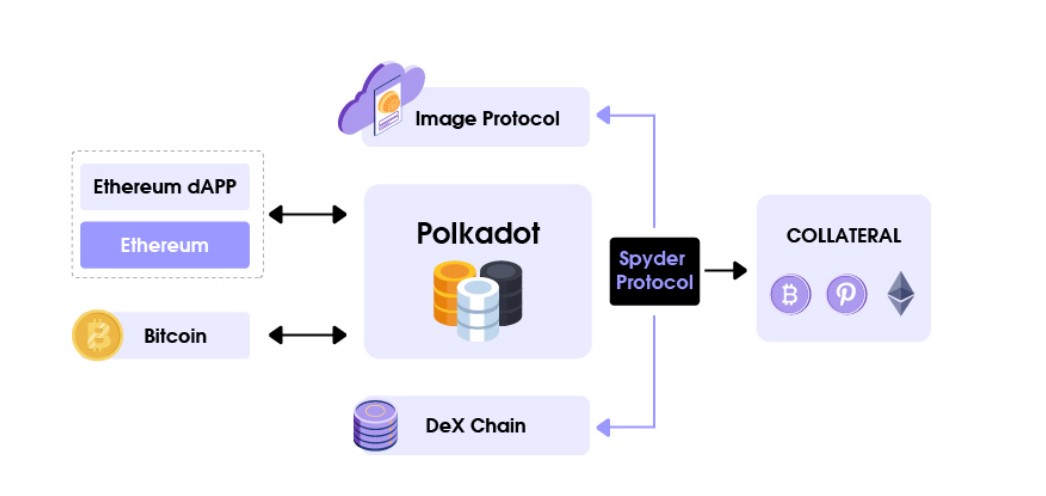

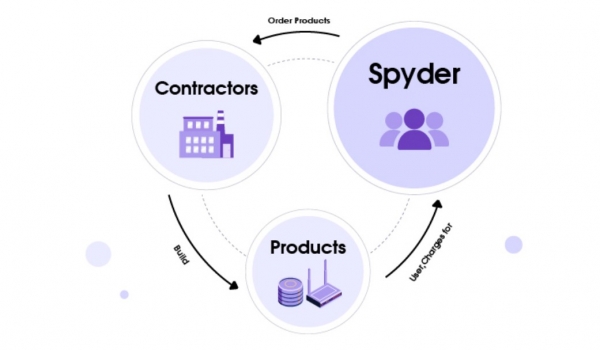

Spyder Protocol is the first cross-chained Substrate-based protocol to support holders of different digital assets through which cross-chain assets are circulated and converted. Spyder Protocol is an important supplementary link of Polkadot ecology and one of the important ways for community to participate in Polkadot parallel chain auction.

Spyder vision is to become an indispensable infrastructure for Polkadot DeFi ecology. from the point of view of product design, Spyder has launched core infrastructure such as auction house, Spyder Dex,Spyder farm and so on. referring to product design schemes such as MakerDAO、Uniswap in ethernet ecology, business logic has been verified and implemented in ethernet, and Substrate technical advantages can be used to improve user experience. For Spyder, it reduces trial and error costs and opens up new markets across chains in Polkadot ecology.

Specifically, Spyder focus more on the upcoming parallel chain auction market and do more in-depth research and services on IPO( first parallel chain auction), where users can exchange DOT step by step, such as holding BTC to participate in parallel chain auctions. By using the Protocol, the project party can also better raise funds (non-destructive, non- ICO) from users to bid for parallel chain slots.

The project layout is wide, the vision is big, needs to have the strong team and the fund support. The project is led by Dr. Brett Kelly, Brett Kelly has many years of block chain development experience, is a well-known Boca ecological developers, and behind a number of venture capital institutions to provide support, abundant funds.

Spyder are currently trying to build a wide range of Polkadot+DeFi, products including auction houses, Spyder farms, Spyder DAO and other derivative plates.The core of the competition for DeFi products is to attract liquidity. The Polkadot ecology is at an extremely early stage. The pattern is uncertain. The first access to slot use rights will gain a preemptive advantage in liquidity and asset growth. Polkadot current chain performance is unclear and the ability to capture liquidity and users is unknown. Therefore, the initial Spyder will be carried out through Heco Protocol.

◇Spyder Token Economics

Why is there a token economy? This question allows us to return to the basic concepts of traditional economics. In fact, whether it is traditional economics or token economy, we are convinced that a basic concept is that human behavior is basically economic behavior, and any action has a motive behind it. First of all, it is easy to misunderstand that the token economy is a new macroeconomic system composed of a variety of encrypted currencies. But in the present situation, the token economy actually refers to the economic model advocated and operated by an individual encrypted currency.

The acquisition of SPR is one of the main motivations in the Spyder token economy. It is an important task for developers to design economic models to let the stakeholders in the network fight for tokens to maintain the normal operation of the network. The motivation of various behaviors in the Spyder token economy is usually inseparable from the motivation of obtaining more SPR, These are all economic interests, because SPR have its economic value, not only can hold SPR can obtain the right to participate in Spyder network, but also can realize money and obtain economic benefits.

Therefore, a good token economy is as important as the block chain itself. A good token economy model should support the security and sustainable development of the network. At the same time, it should benefit all participants in the network, including verifiers, money holders and users, and at the same time make the network grow. Here we publish Spyder usage scenarios, economic models and mining mechanisms.

◇Using scenario analysis

A new approach to financing ——IPO( initial parallel chain issuance)

A parallel chain slot (Parachain Slots) is an interface between a relay chain and a parallel chain, And to share the security of Polkadot networks, Business interaction with other parallel chains, must be achieved through slots. The parallel chain slots are auctioned every six months, Release only one slot at a time. The slot is leased for six months, Divided into 6 months ,12 months ,18 months ,24 months, Projects participating in the auction are free to bid, Bidding for individual or adjacent leases, The high price gets. The winning bidder needs to lock its DOT in the corresponding cycle (KSM will be locked in Kusama), At the end of the parallel chain lease, DOT will be unlocked. The longer the lease, The more stable the network is, Bidding module is provided by Polkadot official. According to Gavin Wood previous introduction, After the Rococo V1 test network runs stably, Will be the first to open the Polkadot first online Kusama parallel chain slot auction, And in the Kusama online auction winning parallel chain, After that, copy the process to the Polkadot host network.

With the development of Boca ecology, more and more people pay attention to Boca and begin to try to participate in the auction of card slot in Boca ecology. And IPO( first parallel chain issue) this new financing method also operates.IPO means if a project decides that they want to bid for an upcoming parallel chain slot, but they do not have the funds needed, then they can use the Substrate crowdfunding module to create an initial parallel chain crowdfunding to accept DOT loans from any DOT holder.Funds obtained through this module will enter an account on the Polkadot relay chain. The DOT loan will be returned to the investor at the end of the parallel chain lease if the project can receive sufficient DOT donations to win the auction. If the project does not receive sufficient donations and the auction fails, the DOT will be returned to the contributor immediately. DOT in this account can only be bound in parallel chains, and the project can not transfer DOT from that account.

When the Spyder designs the network, it also arranges according to the online process of the Polkadot main network. At the same time, because of the cooperation with the Heco, the Spyder network will first mature the network for mobile mining and product development. After Polkadot the main network line, continue to participate in the main network slot auction.

◇Spyder economic models and mining rules

1) consensus mechanism and token distribution

Consensus mechanism is the basic rule to maintain the normal operation of block chain network and to authenticate transactions and blocks. The existing consensus mechanisms mainly include workload certification (Proof of Work,PoW), equity certification (Proof of Stake,PoS) and equity entrustment certification (Delegated Proof of Stake,DPoS).The Spyder uses the NPOS rights and interests proof mechanism to dig the ore, this kind of mining way is more safe, more environmental protection also is more advantageous to realize the token value discovery

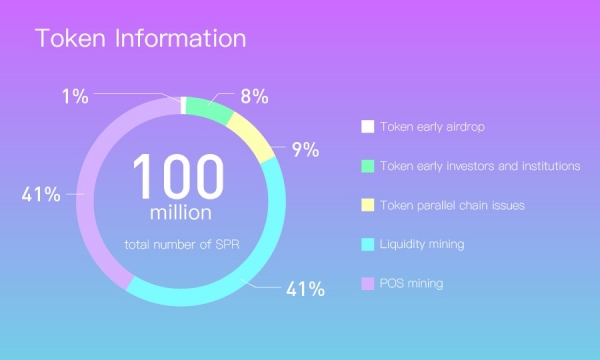

1% early airdrop ;8% early investors and institutions ;9% parallel chain issuance ;82% token borrowing mining and POS

Note: the team part has no reserved tokens and pre-dug, the team's income is generated by the user's associated mining, the so-called associated mining is the user in parallel chain auction, provide liquidity mining, there will be 5% of the team incentive to hand in, The team estimates that tokens are about 2.5% of the total.

5% Team Motivation ,3% Core Team Rewards ,2% Daily Operations

2)Parallel chain auction mining

This part of the proportion is 9, starting conditions for Boca parallel chain auction and product line. The V2 version is known to be online auction house version 1.0 for normal pledge DOT lending card slot, while 2.0 will open the white paper planned multi-currency pledge conversion mining.

Users in pledge DOT and other assets, assets will be locked and released corresponding circulating tokens SPR, The advantage of this mechanism is that it can not only meet the needs of users to participate in parallel chain auctions, but also obtain certain liquidity of assets. Usually, the amount of loans is proportional to the SPR obtained. It is reported that more than 100 well-known projects have announced campaigns for parallel chain auctions, bringing about amazing asset TVL. When the project side creates DOT borrowing requirements on the product side, Users will lend DOT complete the auction process without centralized institutions and organizations.

Part of the auction house's token release ratio is proportional to the number of loans, to interest rates and duration. In addition, in the process of user lending and project loans, the interest difference will be used to buy back SPR, the current interest rate is 3. In other words, all lending proceeds from the platform will support SPR repurchase. In addition, the current auction fee is 5%(this part is produced by associated mining, that is ,5% of the production will be transferred to the project party as the project operation funds and income during the auction mining process)

Moreover, Spyder plan to do its best to photograph the Polkadot parallel chain card slot and synchronize the birth of the founding block. At present, the lease plan is tentatively 3 rounds, each round 1 year, the lease period is 3 years.

3)Liquidity mining

3.1 Mirroring protocols, liquidation logic and SpyderDEX

Mirror transformation

There are borrowers and lenders in the Spyder network, no matter which side of the loan, when the mortgage process is completed, a certain number of SPR incentives can be obtained, which can be simply understood as borrowing or mining. Because the value of digital assets on both sides is changing at any time and the risk changes with the price, it introduces the concept of mortgage rate. To give a simple example: we all know that if you want to mortgage a house or other real estate, the amount of the loan is often not the price of the house on the market, because the liquidity of the house is not strong, the borrower has to bear the time cost of capital and the risk cost of the house falling. In a loan, the market price of a house and the two data of loanable funds, dividing the two data (the price of the house / the amount of the loan), is the mortgage rate of the loan business. Mortgage rate is an important measure of whether the loan is benign. In the encrypted world, because of the volatility of encrypted asset prices, although liquidity may be higher than the house, it is necessary to bear the risk of collateral falling, so to initiate a mortgage, it is also necessary to introduce a mortgage rate index.

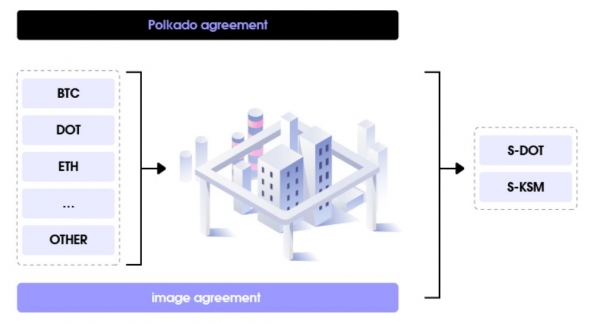

Image protocol is the main way of asset conversion in Spyder network. It is to control the whole protocol through Runtime layer, so that Spyder users can open the transit proposal mentioned above to generate corresponding anchoring assets and complete the conversion between different currencies. It can also be understood as borrowing.

Note: Spyder is a block chain network based on Substrate framework. Runtime layer is a unique module in the framework. It can control the whole block chain network like the brain controls our behavior.

If, Tony now have a A dollar worth $1,500, The mortgage rate for opening a loan is 150. Because encrypted assets fluctuate, So if you want to borrow, Users can borrow up to $1,000 in other digital assets, For example, B coins (1500 divided by 150%), Of course, if you're more risk conscious, For example, think that the price of A coins will fluctuate more in the market, You can reduce the money you borrow, Control at $900 or no more than $1000, Control the mortgage rate (encrypted asset price / loan fund) above 150%.

Because when making mortgage conversion, the liquidity of mortgage is actually locked, and liquidity is an important factor affecting price change. For Spyder networks, the amount of other digital assets that each collateral can lend is limited because of the liquidity of the collateral, which is called the debt ceiling, set by community governance. Once a certain collateral reaches the debt ceiling, it is impossible to generate a complete exchange in a short time unless some borrowers can repay the borrowed digital assets. Among them ,150% is a hypothetical number, which is a key parameter in the system, because Spyder is a decentralized platform that will be considered in terms of collateral market value, liquidity and volatility according to governance. Therefore, the mortgage rate of future collateral is set by community governance. Once the mortgage rate of each loan falls below the prescribed mortgage rate, the user's collateral is liquidated.

◇Liquidation logic

The most important thing in the lending business is solvency, We just learned that mortgage rates are a measure of good loans, So when the target falls below the mortgage rate set by the system, Liquidation is needed to ensure the solvency of the system. The whole process goes back to the example above, When the user borrows, A the market price is $1,500, He mortgaged a A dollar, The user borrowed $1,000 worth of assets, For example B coins, All of a sudden, the price of A coins fell to $1300, Then the mortgage rate in our loan business is 150 percent, It fell to 130. Besides, Another scenario is when collateral prices are stable, Since interest on borrowing is accumulated, And it's when the user pays the loan, So your debt will grow, If you don't pay attention to the mortgage rate, Increasing your collateral or paying off your debts, It also causes the mortgage rate to fall below 150 percent.

So in order to ensure that the system can recover the loan and the liquidation penalty, once the collateral is insufficient, it is necessary to put the collateral of the user on the market for auction, so as to ensure the solvency of each loan. Also, the interest set on the Spyder test network is 2.99%, which means annualized interest, that is, if you lend a $1000 debt to the system, the interest you have to pay is about $0.13 a day. The interest rate of the loan and loan changes as the market changes, and the size of the lending pool determines how many assets the user can convert, and when the market deposit interest rate increases, it will attract the corresponding assets to survive. These assets form a pool of funds in different currencies and provide liquidity for the cross-chain mortgage conversion of the market. After the liquidation triggers, your collateral will first be auctioned on the market, and the users involved in the auction will decide how much price to pay, because the entire Spyder system needs the solvency of the debt. So the primary goal of the auction is to cover the amount of bad debts generated.

We just learned that if we participate in liquidation, we can get a good profit income, but the existing liquidation procedures generally have a high threshold of participation, and need a certain code basis to run the liquidation process. On the Spyder network, in order to enable ordinary users to participate in the liquidation process, you only use the funds prepared to participate in the liquidation auction. Deposit the built-in decentralized exchange (DEX) in the Spyder network, where the built-in exchange participates in the liquidation of the entire network (that is, the liquidation process described above), earning income at the rate of each user's deposit.

◇SpyderDEX 3.2

DEX (decentralized exchange) is to remove all the decentralized centralization of traditional exchanges, including dealmaking and liquidation. The DEX scheme that removes market makers is called AMM (automated Market maker). Market makers (Market Makers,MM) in financial markets refer to individuals or institutions that provide a large number of transactions for the market. Their main purpose is not to profit from the rise and fall of the token price, but to obtain the spread (Spread), which refers to the difference between the highest bid (buy one) and the lowest selling price. Market makers provide liquidity for the entire market (Liquidity). Liquidity means that assets can be bought and sold in the market without suffering a large loss or premium, that is, there are a large number of orders in the market, so that people can buy or sell assets quickly at market prices. Therefore, market makers are also called liquidity providers. Market makers need a large number of tokens to form a large number of orders, and when market prices fluctuate, make sure that one of their tokens will not be consumed.

AMM (Automated Market maker) uses algorithm instead of manual quotation of traditional market maker, and takes a token pool as the transaction object of user. The token pool contains two or more transaction pairs, which have an algorithm that provides users with real-time token exchange rates. Traditional market makers can still participate, adding a large number of tokens in their hands to the currency pool. This token pool is also called the mobile pool because it brings together the liquidity of AMM market makers (LP,Liquidity Pool). The reason why AMM algorithms can provide market prices lies in the existence of arbitrageurs (Arbitrager) in the market. AMM offer prices higher or lower than the market, arbitrageurs come here to trade, get the difference from the market price in return, and bring the price of the AMM pool back to the market price.

◇Algorithm

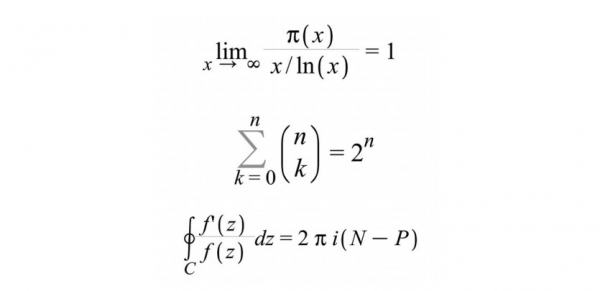

The DEX in the Spyder network adopts the constant product market quotient model, the model is very simple, the formula is х×у=к;

x、y represent the number of different encrypted currencies, the product of which is k,k constant, and the k value is determined by the liquidity of the first injection :1) anyone can create a new trading pair 2) regardless of the initial setting of the k value, Because of arbitrage in the market, the value of the market finally adapts to the market price.

For example, DOT-aUSD, Explain the DEX transaction process, Set initial price aUSD,1 DOT=30 Trading pool DOT reserves of 10 per cent, aUSD 300, If the k value is 3, 000. The process by which a user buys a aUSD in one DOT is (in the case of ignoring transaction fees):

1. users send 1 DOT to smart contracts;

The number of DOT in the 2. trading pool was updated to 10+1 to 11;

The number of aUSD in the 3. trading pool was updated to 3,000/11=272.73;

The number of aUSD received by 4. users is 300272.73=27.27, that is, the price of aUSD purchased by users is 1 DOT=27.27

5. this time, the new k value is 11*272.73=3000.03.

The constant constant k exists to calculate the exchange rate, that is, how many users need to be given aUSD, that is, when the x of the x*y=k, changes, only the k does not change to calculate the constant constant before a transaction occurs. According to the new injection of different numbers of tokens to calculate the number of tokens can be exchanged. After each exchange, a new flow pool (new x、y) is generated, and a new constant is also generated.

The problem with AMM is that when a liquid token pool faces large orders, it creates a slide point (Slippage). Sliding point refers to the gap between the price of the order and the price of the final transaction. Sliding point depends on algorithm, order amount and liquidity size. The larger the order amount, the greater the sliding point, the greater the liquidity, the smaller the sliding point. The better the algorithm, the smaller the slip point in the case of the same order amount and liquidity pool size. At present, the Spyder chooses to set the sliding point limit for the user. The smaller the sliding point is, the less money can be exchanged, but the lowest cost. On the contrary, the larger the sliding point, the more coins can be exchanged, but the higher the cost.

3.3 Flow Pool Mining Rules and Deflation Mechanisms

From the above description, we can see that the order book mode commonly used in the central exchange, to the AMM( automatic market maker) free exchange mode used in the decentralized exchange, the encrypted asset transaction is undergoing a profound change.Users get platform governance tokens, and even use them as "hoes" to "cultivate" new assets, a process that makes trading more than buying or selling.

◇SpyderDEX V1.4 product presentation

Overall ,41 per cent of Spyder confirmed that the mission to ensure the long-term success of the project would remain in the SpyderDEX to produce outputs. these licenses will be chosen by the community to promote Spyder development through mobile mining schemes, community grants and other incentives. The key to the success of the SpyderDEX will be the total liquidity it SPR attract, so most of the certificates will be used to guide the flow of liquidity into SPR., motivated by the liquidity velocity index

The SpyderDEX pool is known to open and support ETH-USDT、ETH-KSM 、ETH-DOT 、ETH-UNI、ETH-HT、ETH-BTC、ETH-WBTC、ETH-SUSHI eight "liquid mine pools" to encourage users to pledge the currency of these trading pairs, thus generating corresponding SPR.

Spyder the total number of mining is about 41 million, the mining period is 8 weeks, the weekly mining quantity decreases linearly, the larger the pledge quantity, the greater the weight, the higher the mining efficiency. All liquidity released after this part of the SPR will not be in the output. Of this amount ,5 per cent will be allocated to the project party as a fee, which will be used as an operational and team incentive

There is a fee dividend in the SpyderDEX incentive model, that is, the user will be charged 0.5% of the transaction fee (the proportion of the investment),0.3% of which will be allocated directly to the active liquidity provider, and 0.2% will be used to buy back SPR, which provides a purchasing power for the SPR.

The Spyder has received Heco attention and support, Spyder is expected to carry out liquidity pledge mining on the MDX.Mdex is the largest DEX, in the current Heco chain that was born in the early days

4)POS farm pledge mining

4.1 Multi-currency liquidity middleware

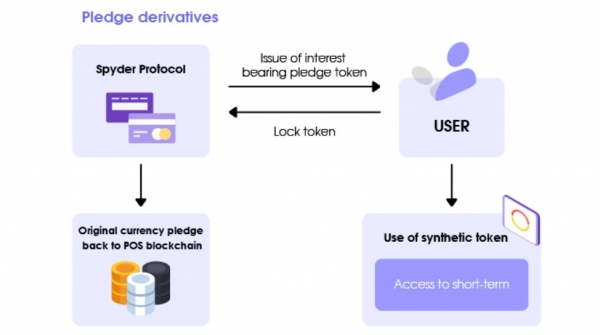

Spyder blockchain network is based on Tendermint+Polkadot consensus. Tendermint is a NPoS mechanism based on Byzantine fault tolerance. There are two important roles in the mechanism: verifier and client. A verifier can mortgage its own token and accept the token pledged by the principal, and the principal can entrust the token to the verifier to obtain the power to govern the network together, so Spyder token in the network should have the attribute of mortgage.

S pyder use NPOS protocols to mine 41% will be awarded through Spyder farms. The advantage of this mechanism is that it can improve the security of the whole network by increasing the pledge rate of the network and give the nodes corresponding rewards.That is, S pyder farms need to pledge to meet the standards to start, similar to FIL, so that early users of airdrop and private placement, so as to effectively activate the S pyder network.

And Spyder farm is a middleware protocol, To provide mobility for the public chain under POS in Polkadot ecology, And when the user Staking the money, Spyder protocol, This gives you a 1:1 bond ——SPR, corresponding to ownership and Staking income rights SPR can circulate freely in the secondary market, And the corresponding token Staking income is completely unaffected. That is, users can use Spyder farm-backed assets for SPR POS mining (currently only three currency DOT BTC ETH).

The core role of Spyder is mortgage, Spyder network verifiers to mortgage Spyder to maintain network security and stability. Specifically, the verifier can pledge itself Spyder, but also buy or lend the Spyder of other users to pledge. The more Spyder the mortgage in the network, the safer the Spyder network.

4.2 Pledge incentives and release mechanisms

Spyder economic model is characterized by aiming at a certain pledge rate for dynamic mining, thus providing sustainable long-term benefits to the verifier and reducing the cost of protecting the network. Below will introduce the parameter choice about supporting Spyder farm economy model in detail. For now, officials have shown that the target pledge rate within 30% of the current volume is the best choice for the following reasons :1) the attacker will have to buy tokens to gain a controlled share on the basis of all mortgage tokens. This purchase, in turn, pushes up the price of tokens. Such a high attack cost is enough to prevent any attempt, especially under a more severe forfeiture system, in which the pledged tokens are confiscated once malicious acts occur. 2) a lower pledge rate, which means that fewer SPR tokens are in a mortgage state, more SPR can be used as collateral for DeFi and Web3 applications, or for other purposes in these projects.

The white paper shows that when 30% of the circulation enters the Spyder farm, the Spyder farm will turn on the switch of network pledge, which effectively reduces the market circulation, achieves the effect of deflation, and reduces the security risk of the whole network Spyder Farm mining will be halved with the amount of mining. When a certain threshold is dug out, the next batch of mining tokens will be halved until the end of mining

The miners' income depends on three parts: the amount of the pledge, the length of the pledge, and the ranking of the ladder of the pledge

Miners in the Spyder farm, according to their pledge ability to obtain block awards.Spyder farm capacity is measured by how many SPR tokens miners pledge in the Spyder farm network.Spyder the storage capacity of the miners on the farm is equivalent to that of the miners in the bitcoin network. The block award received by the miners depends on the proportion of their pledge amount to the total number of net pledges. For example, a miner provides a pledge of 1000 SPR in the case of a network size of 10000 SPR, which will receive 10% of the block reward in the corresponding time.

Spyder is different from other networks in terms of the nature of the service: parallel chain auctions are a longer-term process, usually for several years, Spyder require miners to maintain the stability of the network for a long time. Instead of being like a bitcoin network, miners are free to enter and leave. Hence Spyder use of time-forward growth mechanisms

First, currency holding awards increase with time.

Second, when the holding time reaches a certain stage, it is possible to obtain the airdrop token auction in the Spyder network. The longer the time, the greater the probability of obtaining airdrop. This model market is more likely to read that there will Spyder a similar Cosmos dual-currency model in the future, which Brett Kelly not deny

◇Pledge of the Sky ladder

Spyder farm will make a real-time mining ranking for users involved in Spyder mining, taking the top 10 for an additional 0.2% to 2% of the day before yesterday's mining data, which effectively stimulates users to compete for coins. To get additional network card awards.

In addition to mortgage attributes, similar to other block chain networks ,0.002% of the daily handling fee is generated during the mortgage process. Among them ,0.001% is used to feedback the top 10 network nodes of the Spyder ladder, but 0.001% of the tokens will be burned.

As a result, SPR can immediately reflect and burn tokens until the pledged tokens are fully released.

◇Spyder governance

SPR pass is the key to Spyder DAO community governance, SPR pass holders can use their pass to vote and propose innovations to improve the Spyder DAO ecosystem. SPR holders control the parameters of the Spyder DEX clearing pool and LP incentives, as well as all plans that promote Spyder DAO ecological development.

Spyder DAO the key risk parameters in the main management system, such as stabilizing the annual interest rate, liquidation rate, liquidation penalty, debt ceiling and so on, the mortgage rate and liquidation value of different mortgage assets are different in the future after a variety of assets are online.After determining the parameters, they will be set in the governance module, and the other modules will work together according to the parameters set by the governance module.

Participation in Spyder DAO governance requires holding more than 5000 SPR on 14 natural days to enter the Spyder DAO governance module and vote. Voting requires a 5% voting rate (SPR pass), of which 3% will be allocated to the voting party, and the other 2% will break into the black hole address for destruction.

◇External cooperation

Spyder in December, shark fund equity financing, And in February 2021 with panda capital and other investment institutions to reach strategic cooperation, To complete the $3.7 million seed round financing of the Korean listed company SKIN and KBIPA Association in March, Well financed and well valued, Spyder have very strong confidence in the development of Boca ecology, Also received official praise and support, including Heco, To strengthen further relations Spyder grant applications have been submitted to the Web3 Foundation, Spyder are working with Substrate -based open projects on parallel chain operations.

The Spyder has completed the early bird airdrop and A round of institutional financing as of press day, and the V1 version is expected to launch in April and open the first liquid mining

◇Conclusion

With the SpyderV1 line date approaching, after the above analysis of the known economic model design principle, the conclusion is that the Spyder miners tend to hold money for a long time, and the SPR coin price is the main source to support the miners' long-term mining income. Spyder designed an effective incentive model around data providers and other holders to ensure the alignment of the interests of all participants and the security of the protocol.

Competition between block chain projects is competition on economic models. Therefore, for a complete economic model Spyder protocol, has a very good advantage to motivate and reasonable and scientific deflation model, very optimistic about the future Spyder can play a good role in Polkadot+DeFi cross-chain Protocol.

info@blockchaintoday.co.kr